Interactive Spot Price Gold Chart

Manipulate our interactive spot price gold chart below to help you analyse its trends and use the vast array of tools to compare it to any other metric you feel would benefit your technical analysis.

Add your comments at the bottom of the page.

We have page with a summary of all of the major spot prices, precious metals indices and currencies that have the same look and format as the mini chart in the right hand column.

To use this interactive chart on any of the prices on that summary spot prices page, simply click on its name within the box, such as the spot price gold, and you’ll then be able to drill down on it further.

Enjoy...

Please note that there are few seconds delay as the chart is establishing its real-time connection to the markets.

Interactive Chart Default - XAUUSD

If you like using our interactive chart for spot price gold and think others could benefit from it too, why not share it so they can try?

Alternatively, why not start moving you money outside the banking system and buying physical precious metals?

Getting the Best from the Spot Price Gold Chart

You are able to customise this chart in many ways so that you can see, track and analyse the technicals of equities, bonds, markets, indices and more.

Below are brief outlines of the main features to help you get started on analysing the spot price gold chart.

Time

Selecting Date Range

The default time zones for all items you want to analyse has been set to that of the exchange that is managing the pricing of that particular financial item.

If you want to change and or manipulate the time frames to something specific, then you will find a range of pre-set ranges on the left of the bottom bar, or for a more manual adjustment do any of the following:

- Use the mouse wheel to contract or broaden the date / time range

- Click on the chart & hold, then drag it and the date frame of reference forwards in time (left) or backwards in time (right)

- If you don't like either of the above then at the bottom centre of the chart you will find symbols to click which do the same actions

You will find that the majority of the data is transferred real-time with the remainder being delayed by 10-15 minutes. The top right of the graph window will tell you what the streaming rate is for that particular data set.

After making your changes, if you want to go back to the default time view for the spot price gold chart just click on the middle of the five circular symbols, that looks like a circular arrow, at the bottom centre of the graph.

Choosing Chart Price Intervals

This is done on the right of the top bar.

There are pre-set intervals in boxes:

- 1 minute

- 30 minutes

- 1 hour

- 1 day

The three dots next to the above pre-sets, brings up a box where you can manually add a price interval for your chart, and the drop down arrow next to that brings up a full list of price intervals for you to choose from.

Advanced or Regular Chart Type

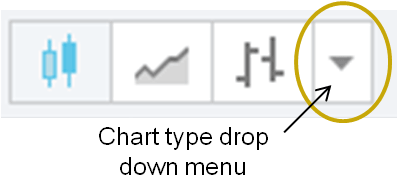

There are 10 chart types that you can select from depending upon what you feel best reflects your needs. To choose just select the dropdown arrow to the right of the button showing the bars. Each type gives you a different view of the market, such as;

- Renko shows if the trend of the price direction is up or down

- Candlesticks show you how the spot price of gold has moved within a certain time period, such as a minute or day

Multiple Symbol Comparison

The spot price gold chart uses the symbol XAUUSD and its performance can be used as a benchmark against the performance of another commodities or index, such as silver spot price XAGUSD or HUI.

Percentage Points

For percentage comparisons, select 'Compare' located at the top bar and add the symbol to be used for comparison against the spot price gold data. This will allow you to compare price movements of your selected symbols as a percentage change of each data set from the start of your selected time frame.

This view can be important to use because if you try to do this with data that are too differently priced and use actual prices rather than percentage changes, the data series will flatten out causing the chart’s effectiveness to be lost.

Actual Price

Whilst percentage change comparisons have their place, analysing actual price difference is also very useful. It's best used to spot minor price differences between two similar / related instruments such as gold bullion ETFs.

Select 'Compare', choose the tab 'Add' and then enter the symbol. Under that tab there is an option of 'Overly the main chart'. If this is left unchecked, your new symbol will be shown in a split screen sitting underneath the original one. If it checked then the symbol will be added into the existing screen mingled with the current data set.

Creating Spread Charts

Spreads charts help to compare financial instrument against another variable. These charts try to provide new perspectives of an instruments' value and it’s thought to help highlight and thus alleviate some risk.

Our interactive chart offers you many different forms of spread chart and probably the two most common and simple to use are:

- Comparisons

- Currency conversions

To use the spread chart feature:

- Add your first variable into the entry box in the upper left hand corner

- Add one of the following four mathematical operators: + - * /

- Add your second variable, again into the same entry & press enter

The intra-day chart spread is calculated by taking the Open, Low, High and Close of each 1-minute bar which is then recompiled into the selected interval. Complex as it sounds, this approach is the only one that results in the correct spread chart you want to see.

Converting Currencies

Dividing or multiplying an instrument by a currency pair allows you to see the price of that instrument in a different currency.

Therefore, if you want to see spot price gold in Euros rather than USDollars you type XAUUSD/EURUSD or XAUUSD*USDEUR as both give the same resulting currency conversion.

Comparisons

You can also use the spread by dividing one instrument with the other. This provides a spread value which can be tracked as if it was a single instrument; for example the silver to gold ratio.

To view the silver to gold ratio, type in XAGUSD/XAUUSD and if you want to view the gold to silver just swap the symbols to be XAUUSD/XAGUSD

Further Information Window

On the right is a medium sized column that shows further information:

- Ask / Bid price details with the day's price movement of your active symbol

- Economic calendar with main financial dates and events

- Watch list summary of various precious metals & indices that you can quickly select to become the main chart symbol

Advanced Technical Analysis

Advanced Price Scaling

You can alter the pricing scale to match your analytical requirements with the following scales:

- Linear

- Percentage

- Log Axis (for extreme price moves)

You can use two separate price scales at the same time; one for indicators & another for price movements. Price scale settings are found at the right of the bottom bar.

Indicators

There are over 100 pre-built technical indicators for you to select such as, Elliot Waves, Volume Profile and Bollinger Bands. Everyone should find something that suits their spot price gold analysis.

You can find the entire indicator library under 'Indicators' at the top bar.

Drawing Tools

The chart comes with 50+ intelligent drawing tools that you can use including:

- Free-hand drawing

- Writing on the chart

- Dragging trend lines from A to B

- Ability to apply Fibonacci and Gann tools, plus many others

If you're after a quick summary of various prices, our main spot price page gives you a clear and simple to follow spot overviews of commodities, major indices and currencies. Please feel free to bookmark our pricing pages to provide you with the greatest ease of return.

Authored by David Gibson:

Authored by David Gibson: