Fundamental Gold Investment Advice

Gold investment advice is typically about telling you exactly what product you need to buy, from whom, when and how much cash you should spend without taking into account your specific circumstances, needs and requirements.

Add your comments at the bottom of the page.

The agenda of every sales pitch (irrelevant of subject) ultimately requires you to part with your cash to the benefit of the salesman.

When faced with someone who is talking with authority on a subject you don't fully grasp it can sometimes be difficult to counter what they say.

Even if you view yourself as far from wealthy, there is a way to invest and benefit.

That is why you need to be armed with the proper tools...

You are Your Own Best Asset

Your knowledge about yourself is your best asset.

Only you really know what your personal circumstances are and that means you are the expert about yourself. Salesmen don't want you to realise that as your actual needs, more often than not, will not really be met by their solutions.

They (including financial advisers) have a set of products they want/need to push onto you and they will force one to fit.

Your intimate understanding of you will allow you to dictate which angle of our gold investment advice fits your situation best. You just need to learn how to come to the correct result.

Below, you will identify what you feel is the best strategy for you to adopt and what to take into consideration before you buy physical precious metals.

Once you have worked your way through the our fundamental gold investment advice, you will then be in a fantastically strong position to better identify what direction is best for you and how to achieve it.

Choosing Your Strategy

I have based the following gold investment advice strategies on the assumption you want to buy allocated physical precious metals bullion. However, these basic principles can also be applied to other precious metals financial gold investments.

You want to aim to eventually have a minimum of 10% of your total assets in your core holding (aiming for 50% is better as far as I'm concerned, due to the state of the financial system). You want to do this to protect and preserve your wealth.

There are 3 main approaches to investing in physical precious metals. You can choose one or implement all three.

- Bulk Purchases

- Average dollar accumulation

- Trading

Bulk Purchases

This is an intermittent approach to buying bullion that occurs sporadically when you have more cash available to you, above and beyond your normal monthly saving.

Examples include; cash made from selling something such as company stock/house/car, or your time savings deposit coming-to-term and being released for re-investment.

For many people and businesses, the initial purchase into bullion typically involves the investment of a lump sum from their savings / reserves. Don't worry if you have little or none as this is covered in the next part under average dollar accumulation.

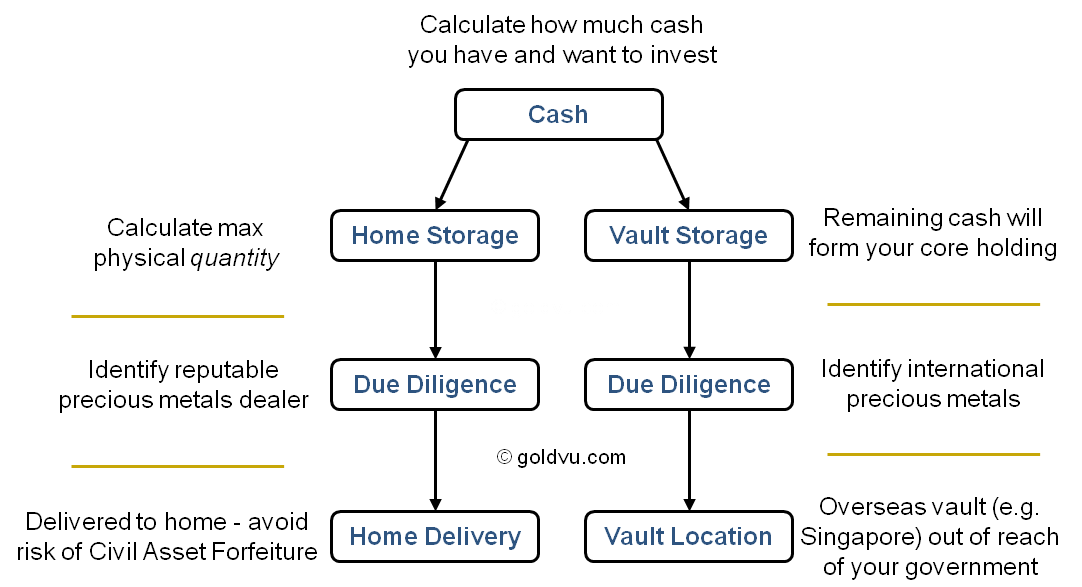

Below are the basic gold investment advice steps that you should follow when making a bulk purchase.

You shouldn't think that you must / should buy bullion for storage at home before using a vault. It comes down to personal preference and the risks you perceive and are comfortable with.

If you feel that it is better for you to first vault the bullion overseas before storing some at home - do it (just be methodical and don't skip the cash calculation and due diligence parts).

Remember when it comes to gold investment advice, you know your needs and circumstances better than I or anyone else!

As a final note;

Don't take this as a suggestion to dump all your life savings into buying gold or silver (which isn't a bad thing to do) as you should always keep some cash on hand.

If you can, try to keep at least 3-6 months worth of expenses in cash. That way you hold off from touching your home stored emergency bullion for as long as possible.

Average Dollar Accumulation

This basically means that you buy your precious metals at regular intervals (e.g. monthly) and is likely to be the most common of our gold investment advice strategies.

These regular purchases would be less in value than the previously mentioned bulk purchases and would typically be what you can set-aside and save from your monthly income.

If you don't have much in the way of savings then the average dollar accumulation method will be a more applicable starting point.

You can accumulate gold and silver by the gram (0.032 of an ounce).

The first few months of 2015 has seen the following average USD$ prices per gram:

- $ 38.50 per gram of gold

- $ 00.53 per gram of Silver

As you can see, you don't need to be earning much to start buying gold and even less to buy silver.

Contrary to what people say -

Building wealth is not so much about how much you earn it.

It's more about what you do with it.

Whenever you buy your bullion, it will be at a different price. You cannot prevent the price from fluctuating, it won't stop, so don't worry about chasing it. Just focus on buying what you can when you can.

Some months, the price will allow you to buy more metal, other times you will buy less. At the end of the year you will have an average price that you paid for it all, hence this strategy's name.

People can become fixated with trying to time the best point to buy into bullion. Few people have the ability to correctly time that. It also causes unnecessary stress when you miss your target or see a cheaper point of entry after you made your purchase.

The process of average dollar accumulation for bullion should be viewed no differently to how you save some money each month. Instead of keeping cash you keep bullion.

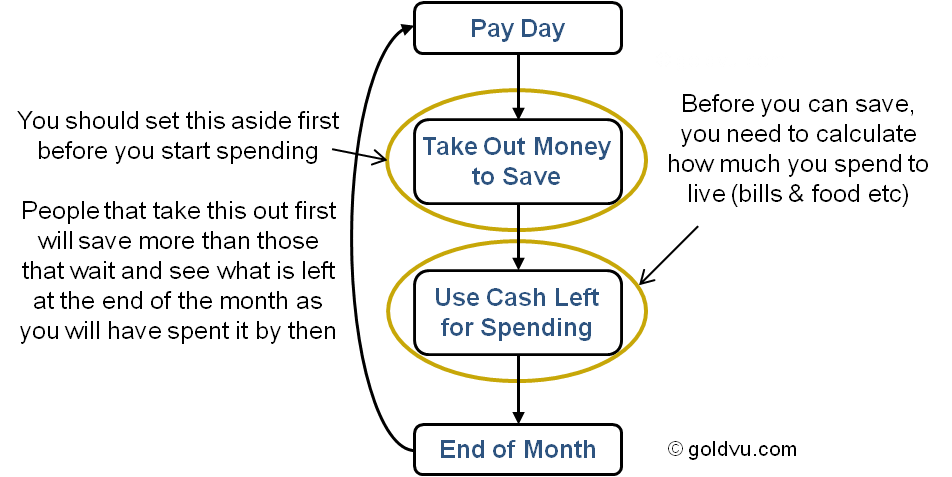

Aside from our fundamental gold investment advice, in case you didn't know, the correct and disciplined way to save is by taking out what you want to save straight after you receive your monthly income. It should happen before you start your daily spending.

Don't wait and see what you have left in your pocket at the end just before you get paid. You will find you've gone and spent it all.

When you buy gold and silver in this way, you should do it at the same time each month.

So if you get paid on the 1st day of the month, buy bullion on the 2nd day of each month.

By using the average dollar accumulation strategy, you:

- Steadily build up your total precious metals holdings

- Develop a position in bullion you might otherwise not have

- Avoid the stress of price chasing

- Develop a good and consistent savings habit

Trading

I'm not wanting to sound negative, however...most people aren't any good at financial trading. Trading will likely be the least popular of our gold investment advice strategies and it's certainly the most difficult.

From my point of view, if you go around saying that you consistently win at financial trades, it usually means you are either luckier than Forrest Gump, possess astonishingly deep knowledge, an HFT algorithm or are likely committing fraud.

However, many people do and can successfully improve their wealth over time through trading. They just win more in value then they lose.

These are people that:

- Create a clear and specific set of trading rules before they start trading

- Don't change their rules half-way through a trading cycle

- Don't get emotionally involved with the markets i.e. give in to greed or fear

As a part of our fundamental gold investment advice, trading gold is something you should only do after you have first created a solid core holding of physical bullion.

The gold you trade must also sit outside of your core holding so as to not impact it.

For more about trading with gold and the simple rules you should use with examples, read about buying gold as an investment for trading.

As a strategy, trading gold should be the last one on your list to pursue.

Store Your Bullion at Home or Away?

For many the choice of storage location is tied to personal comfort. And this is usually a decision driven by fear rather than logic.

This fear usually causes people to only choose either storage at home or storage at a privately operated vault.

I am an advocate of both as each serves a different purpose.

How much should be stored and where is something I approach with reasoning and logic rather than the fear of potential consequences of either choice.

In terms of gold investment advice, my personal preference is to first buy physical precious metals for storage at home and then focus on building up your privately stored core holding. Your choice is yours.

A simplistic summary of my rationale is:

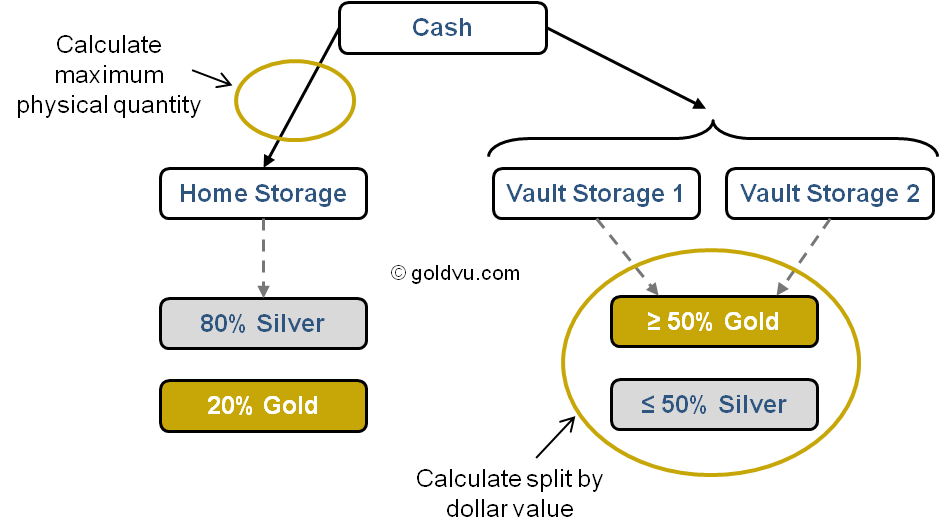

Home Storage

- Should be kept for temporary and emergency situations only.

- The physical bullion should be in small individual units to allow it to be used for things such as barter (i.e. coins or Valcabi CombiBars not Kilo bars).

- The split of precious metals should be at least 80% silver and 20% gold (in terms of physical quantity), with greater emphasis on silver.

Private Vault Storage

- Should contain your core holding which is the primary bulk of your physical bullion.

- Your core holding should ideally be divided between a minimum of 2 different countries.

- The split of precious metals should be 50/50 gold to silver (in terms of dollar value), with greater emphasis on gold.

Furthermore you need to have an understanding of which characteristics of bullion best suit the type of storage and match the state of your finances.

Below is a summary diagram of the above. For a more comprehensive breakdown with step by step calculations and examples relating to storage, go and see our page that discusses how much should be stored and where.

You may have noticed that I suggest a high percentage of silver bullion to include in both storage options. Just because we are focussing on gold investment advice it doesn't mean that we don't understand silver's potential and value. You can apply this to all precious metals.

Physical silver bullion is massive story in itself and I believe that it will offer a far greater percentage profit than physical gold bullion.

When choosing who to use for both home and vault purchases, it is critically important to perform due diligence.

This basically means finding out if they are legitimate and if they have any ongoing issues such as delivery delays.

I have discussed both what to seek and what to avoid when you buy gold and what you should do prior to making your purchase with a simple due diligence process on the dealer or bullion provider.

Any Other Gold Investment Advice?

An often missed piece of gold investment advice is that you need to take into account your future needs (as in after you have bought your physical bullion).

As the future is unknown, the best laid plans and intentions could be turned upside down. Your chosen strategy could help or hinder you in the future.

When it comes down to the actual process of buying physical gold bullion, I go into greater detail on another page where I discuss the best way to buy gold and the various advantages and disadvantages of those main routes.

Some things to take into consideration:

What if You Need to Sell?

A sale could be part of a deliberate plan by you or a hurried forced sale due to an unforeseen event.

Either way, whenever it comes to selling your gold or silver you want to be able to sell it as close to the market spot price as possible and without hindrance.

You will never get a good or quick sale on gold you stored at home as there will always be suspicions about fakes.

Precious metals stored in vaults are normally bought direct from refiners and mints. Therefore it is readily accepted and a good price offered.

Quality of Life

Under the average dollar accumulation strategy there is a danger of trying to over-save.

Saving is good, as it helps to contribute towards your future quality of life. This foresight comes at an expense of today's quality of life.

A balance needs to be struck.

The amount you save should be at a level that you can sustain - don't force any strategy in our above gold investment advice to work if it doesn't fit.

If you over-save, you could cope with it at the start, but a month or two down the line and you will likely let it slip due to the pain of it and your whole savings process will likely come to a halt.

It's no different to everyone deciding to go to the gym at the start of the year and by mid-February virtually everyone has stopped because of one reason or another. And then the next New Year, everyone rushes back to the gym again.

Just keep it at a level you can comfortably and consistently keep. This way you will steadily build up your precious metals savings.

If you feel you need to know more than just the above gold investment advice before you jump in, then find out about the best way to buy gold and why.

Or, if you feel comfortable that you want to go ahead and buy gold or silver bullion that is allocated, physical and privately vaulted for you, then create a secure Holding with GoldVu and keep your savings safely outside the banking system under your direct and private management, just like Central Bank.

Authored by David Gibson:

Authored by David Gibson: