Buying Gold as an Investment for Trading

When buying gold as an investment there are several important aspects that need to be looked at so you don't unnecessarily risk your wealth when performing any trades with it.

Add your comments at the bottom of the page.

With GoldVu, you are able to access 16 physical precious metals markets and trade 19 bullion products. These markets are encompassed onto a single on-line trading platform, MetalDesk, that allows you real-time physical precious metals trading via the Allocated Bullion Exchange.

When buying gold as an investment to trade, we are able to provide you with the lowest spreads in the industry, typically between 0.14 and 0.66% (with silver it's around 0.88%). The fees are also clearly separated so that you can easily calculate your trading parameters.

It is very simple and easy to create a live Central Holding with GoldVu and launch yourself into the world of physical bullion trading. You can also open a Demo Holding that comes pre-funded with $500,000 of virtual cash if you want to give it a try first.

So You Want to Start Trading Do You?

There are 2 ways to look at when it comes to investing into physical gold bullion:

- Trading to make profit (short-term view)

- Preserving your wealth accumulated so far (long-term view)

On this page we will be addressing the first of the two reasons, which is for buying gold as an investment for trading purposes.

The second part is discussed separately, and is to do with the long-term benefits, reasons and strategies for purchasing gold or silver bullion in order to preserve your hard-earned purchasing power.

To start us off, it is important to explain some basic points to highlight why trading bullion is a short-term cyclical process. This will also help to give you a wider understanding of how to trade the physical if you should wish to do so (which I personally don't).

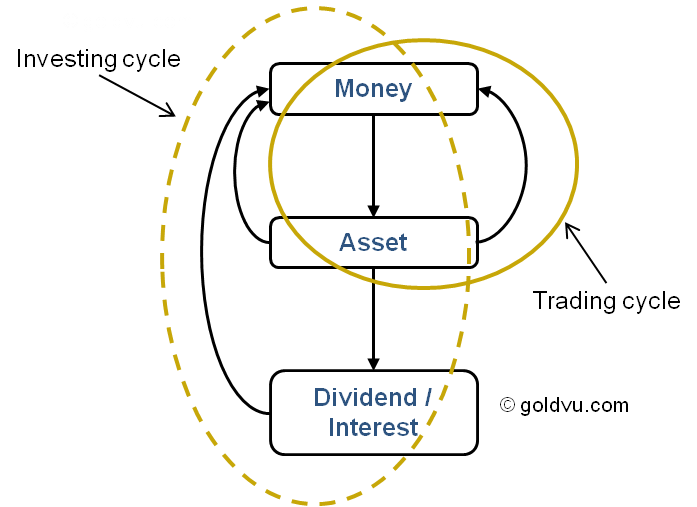

Investing

Is a process that involves converting money into another asset (e.g. stocks) or financial vehicle (e.g. cash time deposit) for:

- Increasing the amount of your total money when you sell that asset

- To receive dividend or interest payments

To put it simply, investing is a deliberate action designed to create a monetary profit (you hope).

Trading

Is a process of repeatedly converting money into another asset and back again in order to make a profit.

I hope you know not all trades are equal...

No-one knows the future. There is no guarantee that the value will go where you expect it, even when you are buying gold as an investment (no matter how many nods and winks you got when receiving that 'quality' information!).

Simple Summary of the Trading Cycles

You need to understand in your own mind, from the above cycles, that buying gold as an investment is really only a short-term approach. It is therefore a form profit-chasing speculation.

For the quick-minded of you - physical precious metals should never pay dividend or interest. If your investment is doing this, then you are likely being scammed or have bought some exotic synthetic financial asset (AKA a paper IOU).

If you aren't sure about the safety of your investments then gain an understanding by finding out what to seek and avoid and also how to go about doing a simple due diligence process for bullion dealers and providers.

Be aware that by buying gold as an investment to trade for the short-term could, as any other form of financial speculation, make a loss.

Simple Ways to Trade Physical Bullion

With buying gold as an investment for trading there are 2 ways to do it:

- Take personal possession every time you buy

- Managing your gold or silver bullion on-line

Trading Delivered Physical

If you are wanting to be trading when physically buying gold as an investment then you should avoid taking possession as a standard method for the following reasons:

- It is a cumbersome process (depending on volume)

- You won't get the quickest of sales as you have to travel to dealer and then their assaying procedures

- You will miss the price you wanted to trade at due to the above delays

- You can't fix a price limit order as your bullion is outside of any accredited vaulting system

- You won't get the best price in general as your local dealer will likely not have enough turnover of physical volume to be able to offer lower fees

You will find it's preferable to use the on-line approach for buying gold as an investment for trading mentioned below. However, aside from trading, it is always prudent to buy small quantities such as Valcambi CombiBars and a small quantity of silver coins to keep at home for emergencies (don't keep more then you are prepared to lose or can carry).

Trading Physical Bullion On-line

There is a common belief that the ability to trade physical bullion can't be done and it's actually in part, or whole, a synthetic non-physical asset. Whilst this is true in the most part, there are some very good 100% physically backed ways to trade gold and silver on-line.

Some have higher fees than others which you need to be aware of when choosing who to use. You don't want your hard-earned profit being taken up through trade execution fees. So make sure you factor this in before you start.

As it is difficult getting access to a reputable physical trading platform that uses fully allocated physical bullion, you will find that the majority of people that buy gold as an investment or for trading tend to get exposure to it through either owning gold mining stocks or Gold ETF Funds.

Both of which come with their own specific risks.

When to Trade if Buying Gold as an Investment

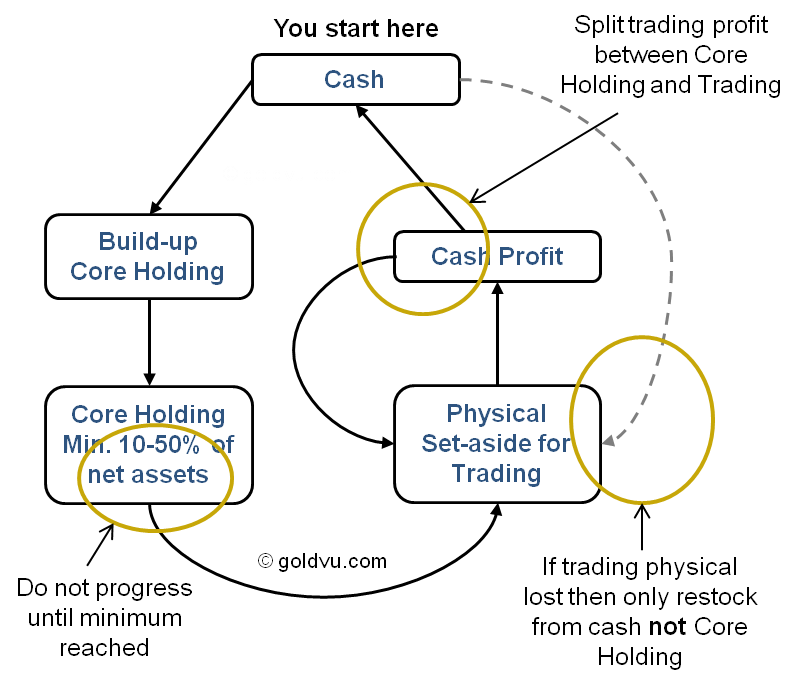

The only time I would consider buying gold as an investment for trading is when you have already established a core holding of bullion.

I would consider a core holding to be an absolute minimum of 10% of your net worth.

However, as the global financial system is so over-indebted and structurally stressed, the minimum you want to aim for is 50%.

In today's financial environment, the larger you can get your core holding, as a percentage of your net worth, the better - the risk of not doing so is just too high. This is why you want to preserve your wealth.

(The bulk of the remaining of your net worth should be ideally invested into some form of productive agricultural land.)

Where people simply want to just buy allocated bullion in order to establish a core holding they will typically use a 'one-stop-shop' company that can buy, sell and store your allocated bullion for you such as GoldVu.

Once this core is established you can then use a set quantity to sell and buy back when the price allows.

You should determine the amount prior to starting trading. That way you don't run the risk of over-stretching yourself and it gives you a real chance to build-up your core holding with as little risk as possible.

Use maybe 1-10% (you shouldn't risk more than that) of your core holding depending on your risk appetite and trading experience.

As with all trading, the trick is to buy at a lower price than the price you sold at.

Make sure you don't forget to include any execution fees or commissions into your price calculations!

How to Trade Gold Correctly

When buying gold as an investment to, make sure you also calculate everything in quantity and not just its dollar price value, because it's the quantity of bullion that you want to increase. The value of the bullion will take care of itself.

Any profit (i.e. increase in physical quantity) you make is then added to your core holding. Therefore over time your core holding increases through;

- Fresh first time purchases from your normal cash savings process

- From your bullion trading profit

As with any trading (and gambling), don't trade more then what you are willing to lose and never take risks to try to win back losses.

So before you start make sure you set a fixed quantity that you want to risk trading with and stick to that amount.

You should also establish simple trading rules such as;

- Of the total increase in physical profit, 90% gets added to you core holding and the remaining 10% gets added to the quantity of your trading portfolio.

For example:

- You made a trading profit that equates to 10 ounces of bullion.

Of that amount:

- 9 physical ounces are bought and added to your core holding.

- The remaining 1 ounce value is added to your trading account.

Don't start digging into your core holding if you have lost your trading bullion.

If you have lost what you traded, then use the cash you save from your day job to buy the bullion back - Don't gamble what you have saved in your core so far!

The point of maintaining a core bullion holding is for long-term savings not a short-term burn up.

Now, at first glance the diagram below looks busy and a bit complex (I couldn't simplify it further), but you will find it straightforward enough if you start at 'Cash' and take it one step at a time. The process is exactly as I have described above.

That is how you safely engage in buying gold as an investment for trading while at the same time building up your core holding.

As a summary, just remember to do the following:

- Work out the minimum percentage for your Core Holding

- Build-up your Core Holding

- Work out the maximum amount to use for trading from your Core Holding

- Work out the split of any trading profit

- Start trading

- If trading position lost, then only rebuild it from cash not your Core Holding

Important Rules of Trading

Trading profitably is difficult, but it can be done.

As there are successful traders in all markets then we will focus on the common important rules they all follow (even if subconsciously).

Avoid emotion

Psychology plays a massive role through greed and fear. Both of which are the primary reason for invested money being lost. There are so many ways in which greed and fear work in the market and these are just a few:

- Greed is felt when making a profit and wanting to hold on for a bit more. The price crashes and you sell for much less.

- Greed makes you buy something that you didn't want to wait to do due diligence on so you don't miss out on profit. You lose on a bad investment.

- Fear prevents you from buying value because no-one else is doing so. You miss a fantastic investment opportunity.

- Fear prevents you from selling a losing position because you think the price might bounce back so you won't lose as much. You wind up losing even more.

Successful traders never get emotionally involved in their investments.

Don't Change Your Strategy Part-Way

Basically, as the title says, don't change your pre-planned strategy part way through a trading cycle. Successful traders stick to the rules created before starting the trade as changes are usually done due to emotion.

Those strategies were created objectively, analytically and without emotion! Remember they were based on how much you want to save and are prepared to lose.

These rules dictate when you buy, sell or walk away from an opportunity without investing at all and what actions you take if it goes wrong or right (hopefully the latter).

If a strategy is changed then it'll most likely be due to emotion (like getting a sure-thing stock tip - see greed).

For more information on strategies for buying gold see our fundamental gold investment advice.

Basic Market Knowledge

Don't rely on luck, throwing darts, or someone else's tips. You might get lucky once or twice, but you will certainly lose more!

Having even a little core knowledge about the market you want to trade in and the best way to do so will give you an edge over the average person and help you to successfully build-up you wealth.

Build your knowledge to the point that you can comfortably pencil out a trading plan, with rules, and what are the real drivers behind the market.

For this (contrary to what you may think) it's usually best to ignore the 'mainstream media' as the various financial channels have interests and motives that don't necessarily align with what's best for you.

Their misinformation is especially high for gold bullion as it directly challenges synthetic fiat paper money such as US Dollars and Euros - which the financial industry don't want as they make amazing profits from all things paper based.

The more you read and learn on goldvu the more you will understand this.

Now you know a bit more about buying gold as an investment for trading as a short-term strategy, if you haven't done so already, then it's time for you to learn about bullion's ability to preserve your wealth and purchasing power.

GoldVu's online physical precious metals trading platform gives you the perfect opportunity to safely and simply trade allocated physical bullion at wholesale prices on 9 different major global precious metals markets. To test it or sign-up for a full Holding visit our registration page.

Authored by David Gibson:

Authored by David Gibson: