Are Gold and Silver Prices Approaching A Major Inflection Point?

Since the gold and silver prices were absolutely hammered in 2011, in an 'apparently' well-orchestrated price take down, both metals have been subjected to what 'appears' to be an unrelenting price suppression scheme that has increased in its intensity to the point where it has now become egregious.

This 'apparent' price suppression scheme of gold & silver appears as if it may have been blended with a psychological element, insofar as the waterfall declines of gold and silver prices are often counter intuitive, in that they seem to happen, for no obvious reason, other than they seem to happen just as a bullish up leg in price seems to be gaining momentum. This repetitive price suppression action has had a very demoralising impact upon the psychology of the average western precious metals investor, and has taken a toll on fundamental bullish sentiment.

Market Action

The market action leading up to these waterfall declines strongly suggests that the 'commercials' (mostly large bullion banks) use 'naked' shorts to soak up any surges in buy orders placed by 'speculators' so as to cap the price until that bullish cycle of buying appears to have exhausted itself. At that point, the commercials place mega sell orders which in turn triggers 'sell stops,' thus building momentum on the downside, thereby enabling them to cover most, if not all, of their recently placed 'naked' shorts.

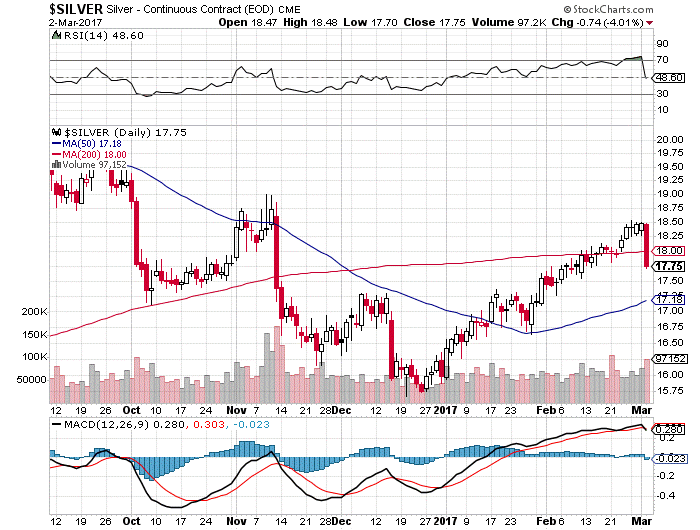

The silver chart below provides a good example, as it includes four waterfall declines during a six-month period!

The above chart is not indicative of free market action. Instead, these waterfall declines strongly implies that price suppression was the primary motive, rather than 'selling silver for profit.' Particularly, when one considers that the current silver price is ~ 67% below its 1980 price, despite reports of 17 consecutive years of supply deficit totalling 1.8 Billion ozs; even after taking into account recycled silver!

As a result, there have been recent reports that many long-time western gold and silver bulls have capitulated, and have been selling down their precious metals investments in favour of supposedly greener investment pastures, which in itself is a contrarian indicator that perhaps the worst is over.

It is worth noting that billionaire Stan Druckenmiller is the latest major investor to announce that he has acquired a substantial gold position. Also, several national central banks in the East are officially reported to be steadily accumulating physical gold bullion at a rate of ~ 500 tonnes of bullion per annum for the last several years, as are some large sovereign funds.

Gold and Silver Price Suppression

How Undervalued Is Silver?

Estimated 2016 paper notional silver trading ratio to physical silver investment of a staggering 517 to 1 !!

The apparent price suppression scheme has resulted in silver currently being the world's most undervalued financial asset. The fact that the regulatory agency CFTC (Commodities Futures Trading Commission) has failed to detect any foul play in the face of a mountain of very compelling anecdotal evidence speaks volumes.

Recently Deutsche Bank admitted to being guilty of manipulating both the gold and silver price fixes. That is the first time that a major bullion bank has admitted to manipulating the precious metals. As part of the court ruling, Deutsche Bank will assist Plaintiffs in the prosecution of their claims against the non-settling defendants. A US Court has ruled that manipulation lawsuits may now proceed, however, the defendants have recently submitted a plea to overturn that court decision. Further developments are awaited.

In addition, the US Supreme Court has ruled that JP Morgan Chase is to stand trial for violating antitrust laws & for rigging the COMEX silver price.

How It Affects the Precious Metals Miners

The current unrealistically low precious metals prices have undoubtedly made it economically unjustifiable to build many of the new mines needed to replace the production of those mines that are nearing, or have reached, the end of their productive life, or which have been shuttered due to being uneconomic at the current low gold and silver prices. As a result, global precious metals mine production is now on the cusp of declining; indeed, silver production fell in 2016 for the first time in many years.

Taking a potentially viable gold or silver mine economic feasibility study forward through the process of acquiring the necessary permits, finding suitable funding for the estimated capital expenditure, and building the mine with all the necessary attendant infrastructure, can take 10 years, or even more with increasing environmental regulations. Bearing in mind that the current 'engineered' precious metals bear market started in 2011, it follows that when global mine production starts to decline, that annual decline will continue, and deepen, for several years, exacerbating any current supply issues, before any new mines can be brought on stream.

The problem in suppressing the gold and silver price at such artificially low price levels is that it has produced recent intermittent signs of shortages, as physical supply constraints gain traction, which is the Achilles’ heel of this 'apparent' price suppression scheme. In the face of supply shortages, aggravated by an embryonic decline in global production levels, a 'synthetic paper' driven price will prove to be unsustainable.

Challengers to the Price Suppression

The Shanghai Gold Exchange is based upon physical gold & silver, requiring 'futures' shorts to deposit physical metal upfront, which is setting the benchmark for the new gold and silver price exchanges in Hong Kong, Singapore, Dubai and Moscow.

The Shanghai Gold Exchange handles the largest physical bullion trading volume in the world, by a very substantial margin. However, futures contracts are currently restricted to within China only, but that is about to change, as Hong Kong prepares to step into that breach, as it has just been announced that the Hong Kong Gold Exchange will be introducing physically settled CNH and US$ denominated Gold futures contracts. This will be the first time that it will be possible to trade physical gold futures contracts denominated in both CNH and US$ on the same trading platform.

Any entities that wish to issue short futures contracts will have to deposit the physical metal up front with the Hong Kong exchange. The Hong Kong announcement did not make it clear if the other precious metals were included, however, it would be logical for silver futures to be included along with those for Palladium and Platinum.

Interestingly, these Hong Kong futures contracts will be available for trading 16 hours a day, which will overlap both London and New York trading times. It will therefore be possible, for the first time, for traders to take advantage of any appreciable gold and silver price differential between the West and the East through utilising arbitrage.

Pressure on the Paper Gold and Silver Markets

Bear in mind that London and New York's gold (and silver) markets are very predominantly 'paper' markets; particularly New York’s COMEX, which over the last several years has only delivered an average of ~ 50 tonnes of physical gold per annum. This Hong Kong development will place COMEX, GLOBEX and LBMA under added pressure going forward, as physical gold and silver bullion drained from the vaults in the West to meet the very strong demand in the East will only be exacerbated. That trend will only be intensified when, rather than if, the developing gold exchanges in Singapore, Dubai and Moscow follow suit at some time in the future, and as physical gold and silver trading volumes increase.

It seems as if physical supply constraints are gaining traction, and if that is so, then those operating the 'apparent' price suppression scheme may decide that it is preferable to allow gold and silver prices to rise in an orderly manner as in the period 2002 thru April 2011, rather than waiting for the physical demand to outrun the 'readily available' physical bullion supply at these artificially low prices, in which case the increase in the gold and silver prices will very likely be sharp and disorderly.

The Future of Precious Metals

It is also worth noting that, following on from the recent Sharia approval of guidelines for gold as an acceptable investment vehicle, and in line with the Sharia dictats in that regard, Dubai has just launched a blockchain based crypto currency that is backed by gold.

This may well be the thin edge of the wedge, as it is extremely likely that many more Sharia compliant, technologically savvy, gold products will be developed and introduced going forward, to meet the gold demand that will arise from the Sharia ruling, and the cultural affinity that World's Muslims have towards physical gold. As time passes, these products will only add further pressure to the already tight gold supply at today’s low 'synthetic paper' driven prices.

The bottom line is, that it is entirely possible that both the gold and silver price are approaching a major price inflection point that will launch a long overdue and substantial uptrend which may well only plateau when a true physical price/supply equilibrium is eventually reached.

Article by: James S Gibson

Date of article: 02 June 2017

Please note that none of the content within any articles on the GoldVu website are offered as investment advice and should not be construed as such.