Full Brokerage Trading Platform for Physical Allocated Bullion

Institutions and brokers looking for a comprehensive allocated bullion trading platform from which they can directly access 7 of the world's major physical precious metals trading hubs, can do so through the full brokerage version of MetalDesk.

We welcome your comments & feedback which you can add at the bottom of the page, or join one of our Social channels:

The full brokerage MetalDesk precious metals trading platform offers institutions something new and unique to complement their existing services.

To-date buying physical precious metals could only be directly sourced from the various bullion markets by telephone / manual ordering and it is also impeded by the twice daily fix.

Through MetalDesk you are now able to trade allocated bullion 23 hours a day globally with constant real-time regional price discovery, which allows for the possibility of inter-market arbitrage.

MetalDesk - The Allocated Bullion Trading Platform

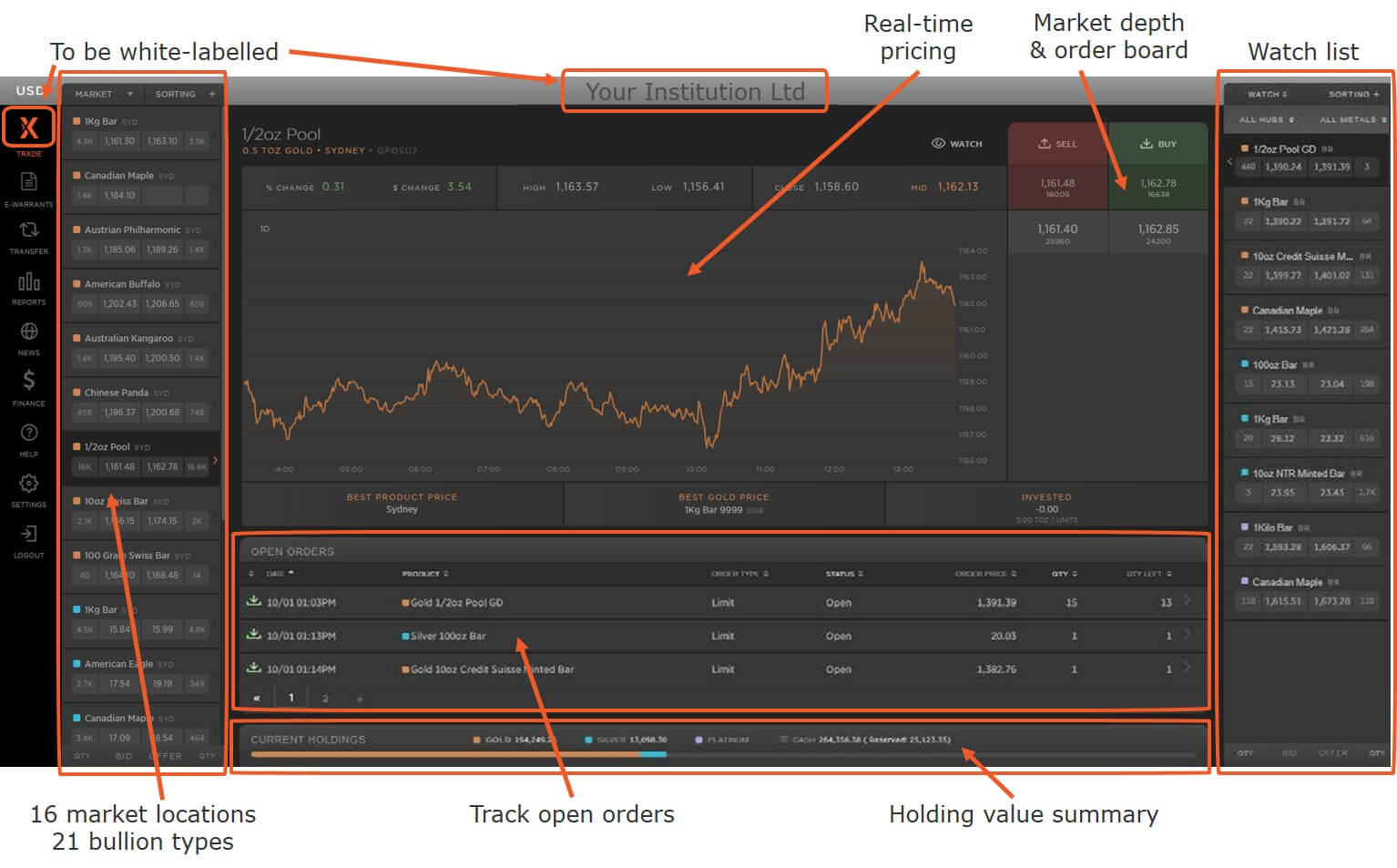

Below is the home screen of the full brokerage MetalDesk and your primary workstation view. From within this screen you can:

- Access all 9 of the precious metals marketplaces

- Track multiple bullion products & types across those markets

- Identify the cheapest bullion item in the world markets

- See the order depth of each bullion type on each market

- Create and manage buy & sell orders

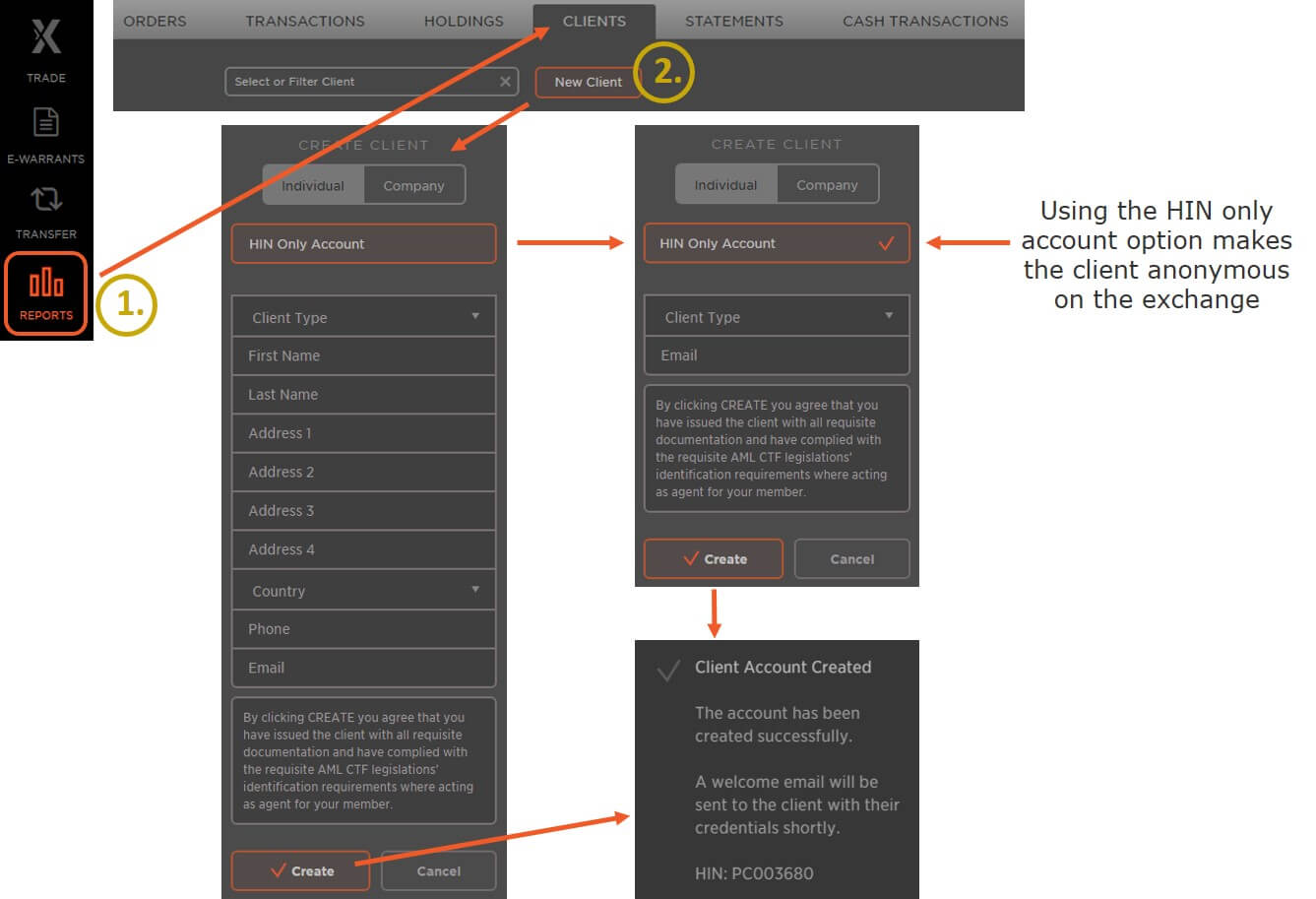

Anonymous Numbered Client Accounts

Currently there are many concerns that the legacy precious metals markets are not only being front-run, but that the identity of the client is known, allowing traders to execute the best / most appropriate front-running strategy.

The exchange has been designed to prevent the front-running of orders and MetalDesk also allows you and your clients to place trades completely anonymously.

Clients can be registered on the exchange by only a Holder Identification Number (HIN). Institutions & brokers registering HIN only accounts on the exchange will be responsible for managing the client's identity on their own internal and separate CRM system.

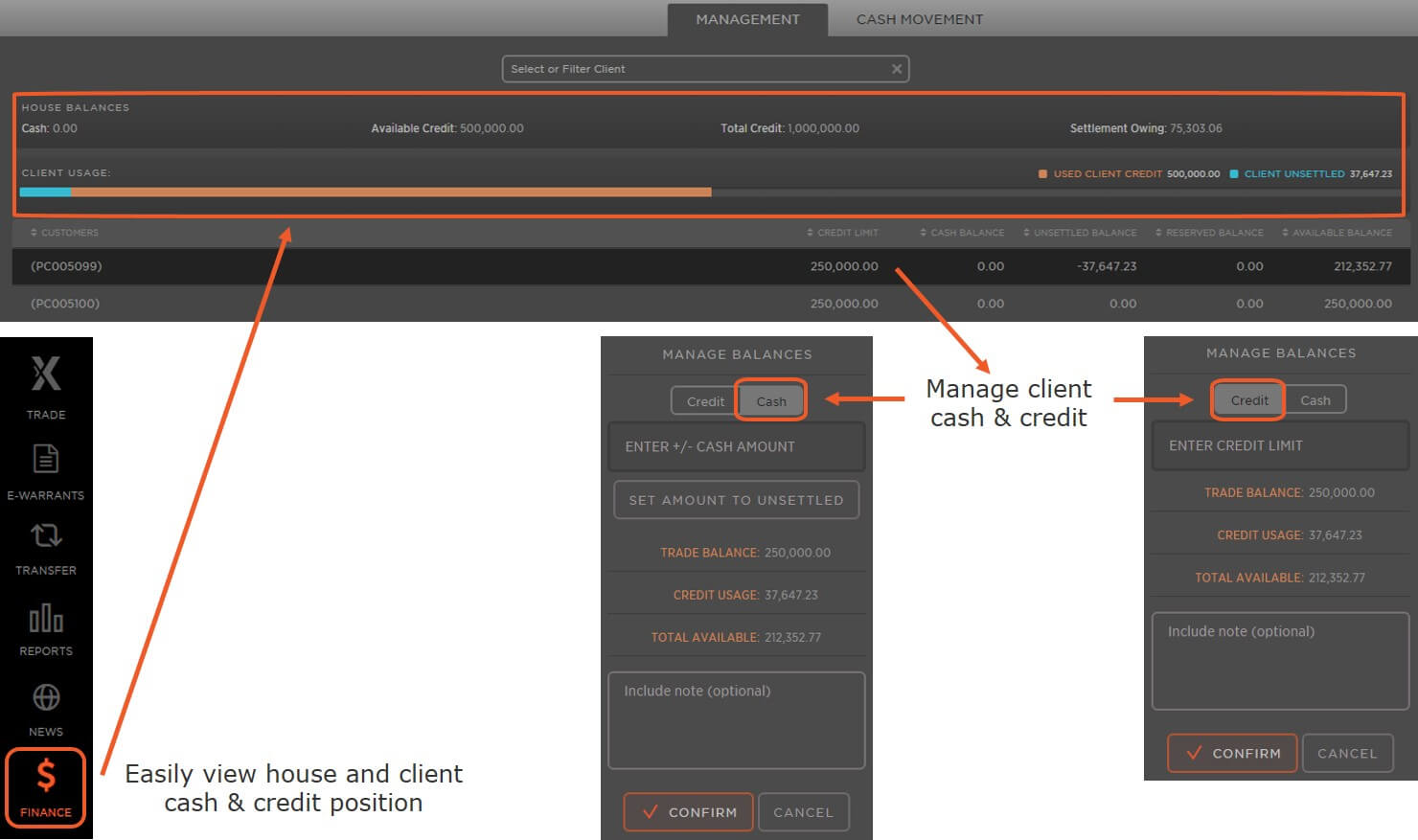

Credit Line & Cash Management

Only properly licensed institutions & brokers can use this full brokerage version as it provides the use and management of credit facilities.

However, the credit line available is based on the amount of collateral deposited in the exchange's Trust account.

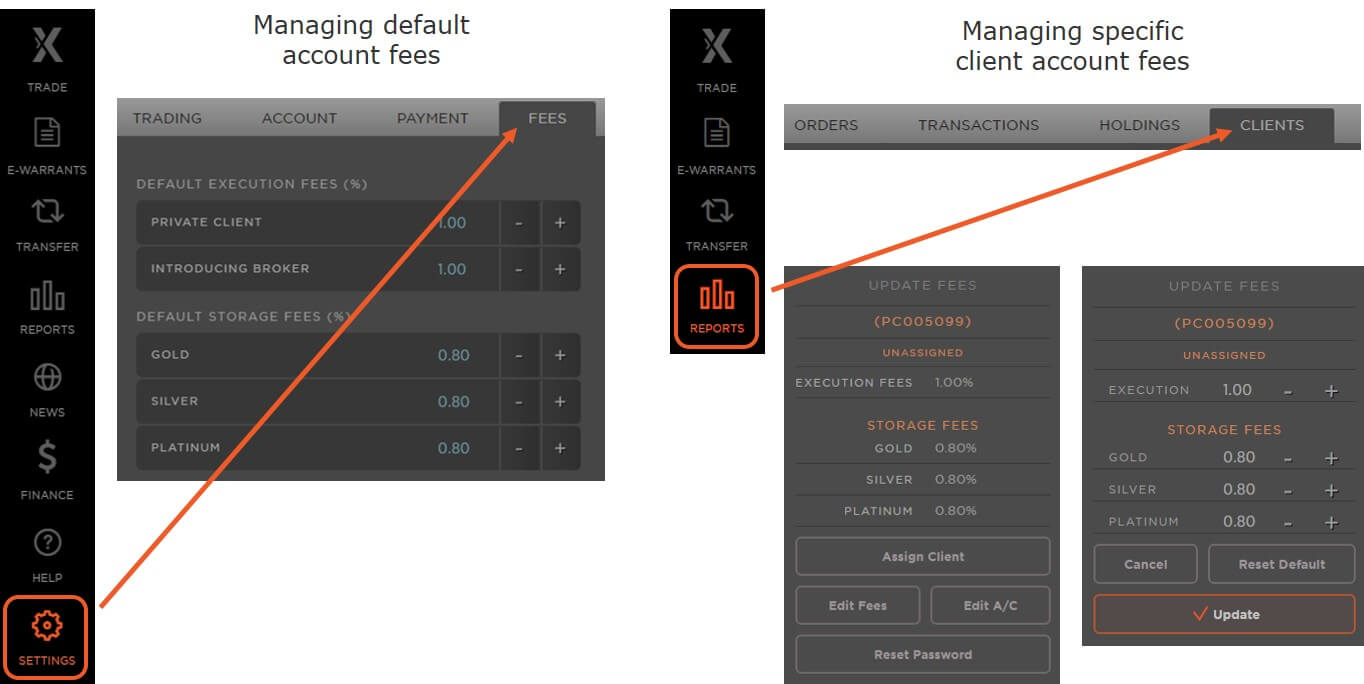

Fee Management

MetalDesk has two fee management windows. The first is for setting and managing default fees that auto-populate new client accounts. The second allows for the amending of fees for individual client accounts.

The fees available to be amended are:

- Each trade execution for all metal types

- Storage for gold per annum

- Storage for silver per annum

- Storage for platinum per annum

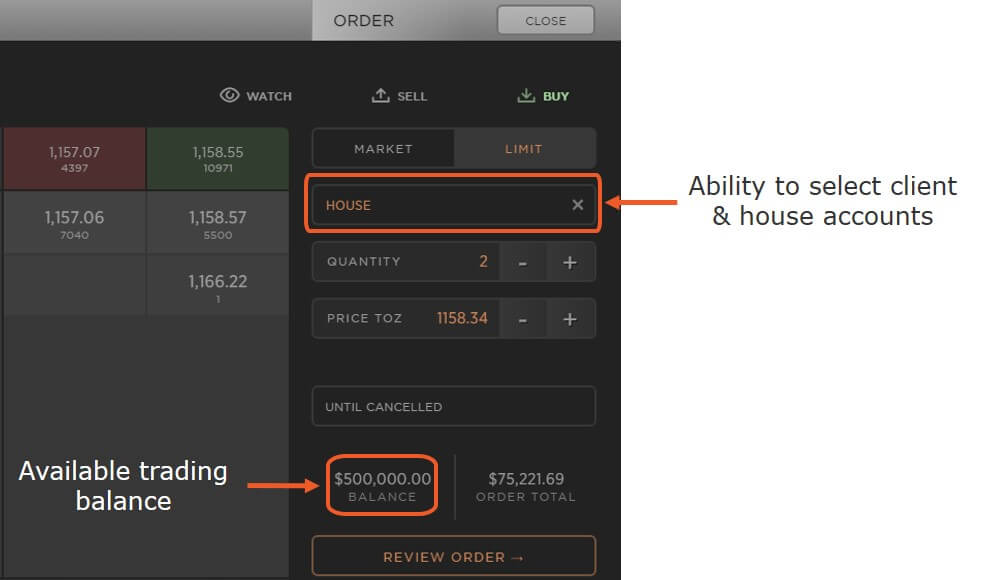

Client & House Orders for Allocated Bullion

Buy & sell orders are initiated from the home screen once you have selected the bullion type you want to trade. The order board gives you the option to action a trade for either the House or a client and to action the order at market or with limit.

Everyone's available balance is clearly shown for each trade.

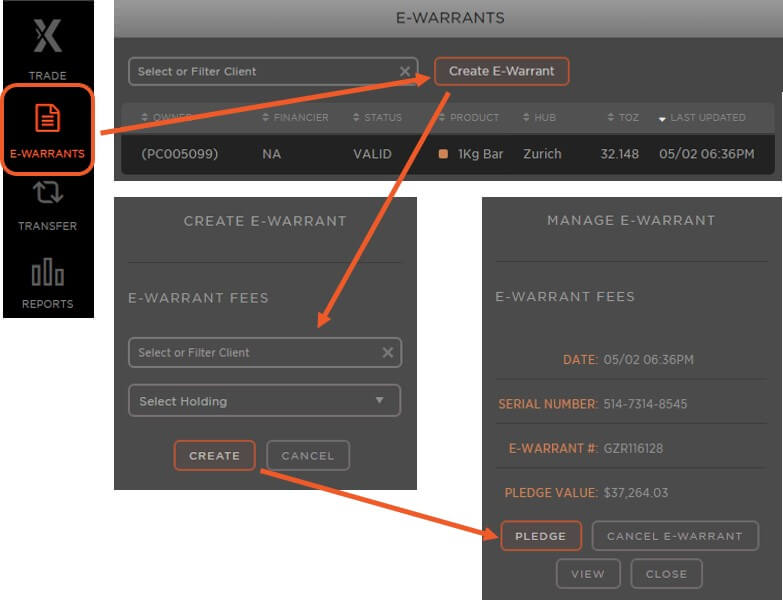

Using Physical Precious Metals as Collateral (temporarily unavailable & to be re-introduced soon)

Anyone holding certain restricted types of bullion products can pledge them to you as collateral for margin capital which they can then use to trade in other asset classes you offer.

This gives your clients the ability to generate & release valuable trading liquidity based on their vaulted allocated bullion, which in-turn, increases your liquidity and turnover.

This ability to pledge physical precious metals is actioned through the exchange's electronic Vault Warrants (eVW). The eVWs can only be currently raised against:

- 1kg 995 gold bar

- 1kg 9999 gold bar

- 10 toz gold bar

- 100 toz silver bar

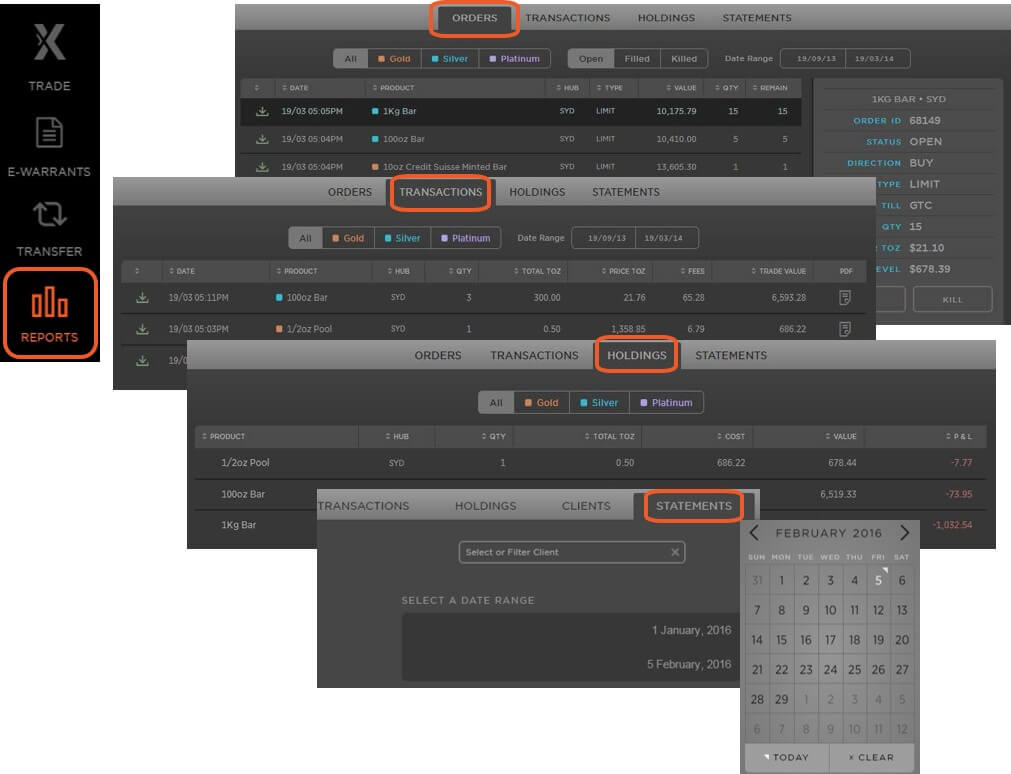

Comprehensive Reporting Facilities

MetalDesk comes with a comprehensive range of exportable reports that will provide you with all current and historical data relating to:

- Clients

- Trades (open / filled / killed)

- Cash transactions

- Holdings of cash & vaulted bullion

- Real-time monitoring of your holding's profit & loss

- Full statements of account

The Allocated Bullion Exchange and the MetalDesk platform brings a revolutionary change to the physical precious metals global trading arena.

Any institutions or brokers wishing to gain access to this exciting new way to trade gold, silver & platinum can easily do so (pending minimum criteria).

Contact GoldVu to enquire about integrating with the ABX and to discover the new opportunities that you can bring to your clients.

Authored by David Gibson:

Authored by David Gibson: